Contents

Wholesale car values show how much dealers pay for used cars before reselling them. These prices come from auctions and trade-ins. They set the foundation for what a car will cost on a retail lot. In the automotive industry, wholesale pricing depends on demand and market supply. That means a car’s value is never fixed; it’s price relative to what people are willing to pay today. Buyers use this info to avoid overpaying. Sellers check it to price cars correctly. If you want the real value of any used vehicle, wholesale vehicle data is where you start.

What Is Wholesale Car Pricing?

Wholesale car pricing is the baseline cost dealers pay when buying cars wholesale from auctions, fleet sales, or trade-ins. It reflects the vehicle’s value before any detailing, repairs, or profit margin is added. Most major market segments have unique pricing behavior that shifts with trends in supply and demand. These numbers offer real industry insights and help both buyers and sellers understand the true starting point of a vehicle’s market value before any retail markup appears.

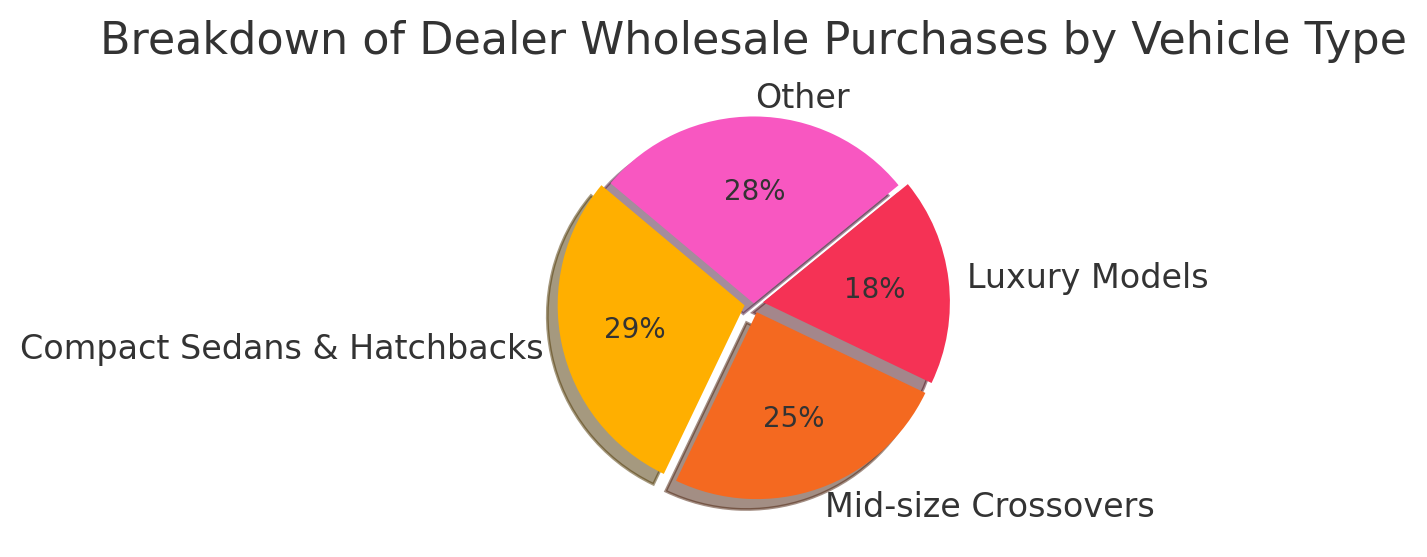

This research from SCA Auctions shows how dealers allocate wholesale purchases across various vehicle categories. Compact sedans and economy hatchbacks make up 29%, driven by affordability and quick turnover. Mid-size crossovers hold 25%, offering flexible resale options. Luxury models represent 18%, appealing to high-margin buyers. These patterns show how purchase strategies differ across segments. Due to them, customers and sellers realize what most major market segments look like from a wholesale perspective.

Key Factors That Affect Wholesale Prices

Wholesale auto prices shift week by week. Supply, buyer competition, and timing are the main factors. The first two weeks of each month often show stronger pricing due to fresh inventory and dealer urgency. A reliable VIN decoder helps compare non-adjusted price change history across vehicle types to spot true market trends.

How Auctions Influence Wholesale Vehicle Pricing

Most wholesale transactions happen at live or digital auctions. Fast-paced bidding sets market value.

- More bidders mean higher final sale prices.

- Clean titles and visible condition reports attract stronger offers.

- End-of-quarter fleet liquidations can drag prices down.

- New car shortages push desire for specific used models.

How Seasonal Trends Impact Wholesale Auto Prices

Wholesale pricing patterns often follow a seasonally adjusted curve. Compared to last year’s level, some segments spike in spring while others dip after summer.

- Tax refund season fuels interest in low-cost sedans.

- Trucks and SUVs sell better in late fall before winter.

- Luxury models usually slow down after December.

- Convertibles peak in early spring but drop fast after May.

SCA Pro tip: Watch non-adjusted price change reports weekly. Even small moves signal big shifts in buyer behavior, especially right after holiday weekends.

How to Check a Used Car’s Wholesale Value

Planning to understand how to find the wholesale value of a used car? Start by checking the used vehicle value index from trusted market sources. This metric tracks price shifts on a year-over-year basis. It reflects what dealers actually pay. Add economic and industry insights like interest rates or fuel costs to get context. The value of a reconditioned car will often sit higher than the base wholesale price. It runs roughly 10% to 15% above. Accurate pricing starts with real wholesale benchmarks, not guesses.

Quick tip: Checking wholesale pricing? Compare similar models with the same trim and mileage. At SCA, cars with clean titles usually sell 12% to 18% higher than those without.

Comparing Wholesale vs Retail Prices

Wholesale vehicle prices often decline in the first half of the year as wholesale supply grows and valuation models early in the cycle struggle to reflect current conditions in the overall industry.

| Metric | Wholesale (Jan–Jun) | Retail (Jan–Jun) |

| Average unadjusted price | $17,250 | $22,800 |

| Inventory growth (first half) | +14% | +5% |

| Price decline from the January baseline | −5.6% | −1.8% |

| Current conditions influencing price | High supply, low dealer urgency | Consumer hesitation |

| Data basis | Based on industry-wide transactions | Dealer lot pricing trends |

How EVs and Hybrids Are Changing Wholesale Pricing Models

Electric vehicles and hybrids are reshaping how dealers evaluate wholesale used vehicle prices. Recent inventory data shows a growing supply of EVs entering the market, which lowers resale demand in some regions. The average move between hybrid and gas-only models now shows an average difference of $2,400 at auction. This gap affects future expectations as more automakers shift production toward electrified options. Dealers are adjusting pricing models weekly. This reflects how fast technology, battery range, and government incentives change the game.

How to Use Wholesale Pricing to Negotiate With Dealers

If you know where a car sits in the wholesale car market, you may count on real leverage during negotiations. Utilize current pricing trends, not outdated listings. Come prepared with numbers from an independent source. Don’t rely solely on what the car dealer says.

- Compare the rebuilt car price to similar clean-title vehicles to argue for a lower offer.

- Reference the three-year-old index to show depreciation patterns over time.

- Track how consumer sentiment shifted compared to the prior month to spot soft spots in pricing.

- Mention that if the vehicle sat unsold for weeks, dealers may cut faster to move inventory.

- Always verify the condition and VIN before making a final offer.

Wholesale Price Red Flags: When a Low Price Signals a Problem

In wholesale markets, a price that looks too good can point to flood damage, salvage history, or rolled-back odometers. Always compare mileage and seasonally adjusted values to current market prices before trusting a low bid.

| Red Flag Scenario | Average Wholesale Vehicle Price Drop | Common Cause |

| Below-book SUV in summer | −18% | Off-season interest |

| Full-size truck during fuel spikes | −22% | Unleaded gasoline over $4 |

| Sedan with mileage under 40K | −15% | Odometer tampering suspicion |

| EV priced under the segment average | −19% | Battery degradation concerns |

Pros and Cons of Using Wholesale Prices as a Buyer

Using wholesale vehicle pricing helps buyers minimize car depreciation by revealing what a car is really worth before dealer markups. On a seasonally adjusted basis, shoppers who buy during the first half of the year often find better deals. It’s due to higher supply and lower demand. The average wholesale-retail price difference can range from 15% to 25%. These figures ensure room for negotiation. Comparing prices day to day compared to previous listings also helps spot sudden shifts or hidden markdowns.

The downside is that wholesale numbers don’t show the full story behind a car. Many vehicles priced near wholesale need mechanical work or have cosmetic damage. Retail sales include inspection, reconditioning, and sometimes a short warranty, all missing from wholesale figures. Without checking the condition or accident history, a low price can become a costly mistake. Relying only on the average price without understanding how seasonally adjusted values apply to your market can lead to overconfidence during negotiation.

What Vehicle Types Hold Wholesale Value Best Over Time?

Some vehicle types hold their value longer in wholesale markets, especially when tracked across multiple months. Non-adjusted values in the final week of each quarter show that stability depends on segment, demand, and timing.

- Pickup trucks often lead in retained value due to their utility across regions.

- Mid-size cars remain steady thanks to balanced fuel economy and family use.

- SUVs do well during colder months and resale cycles.

- Compact car segment sees sharp seasonal dips but quick recoveries.

- The luxury segment shows the biggest drops when interest rates rise.

- Economic and industry insights help explain these shifts over time.

Summary

Wholesale vehicle prices show how much dealers pay before resale. This gives buyers a clear way to judge if a retail offer is fair. Wholesale new car prices act as a pricing anchor across all market segments. Changes in wholesale supply drive prices up or down. The current market trends and buyer demand determine the situation. A seasonal adjustment filters out short-term noise to show real trends. Sometimes, wholesale values are falling. This signals more leverage for the buyer. Tracking this cost benchmark helps avoid overpaying and spot the best timing to buy.

FAQ

Can I Get Wholesale Pricing If I Buy Multiple Cars at Once?

In some cases, yes. Independent buyers usually cannot access dealer-only wholesale rates. However, bulk purchases can unlock volume discounts. This particularly concerns buying at auctions or from fleet sellers.

Does Accident History Significantly Lower Wholesale Value?

Yes. A vehicle with a reported accident can see a drop in wholesale value. It may reach from 10% to 40%. A drop depends on severity. If an accident involved frame damage or airbag deployment, the value reduction is stronger. Branded titles like salvage or rebuilt push that number even lower.

Can I Sell My Car at Wholesale Price Directly to a Dealer?

Yes, but expect a lower offer than retail value. Dealers use wholesale costs to cover reconditioning, marketing, and profit margins. Sometimes, you may need to sell quickly. In this case, going wholesale can be faster and safer than a private sale.

Can a Car Have Different Wholesale Values in Different Regions?

Absolutely. Certain factors, namely, regional demand, fuel prices, weather, and local inventory, affect pricing. For instance, compared to urban coastal areas, 4WD trucks often hold more value in northern states.

How Often Does Wholesale Car Value Change?

Weekly. Most pricing indexes update every 7 days, especially for high-volume models.