Contents

When a brand-new car doesn’t sell, it doesn’t end up abandoned. Dealerships have established systems to make sure every vehicle eventually leaves the lot, whether through price adjustments, special programs, or alternative sales channels. The exact path depends on timing, demand, and market conditions, but the goal is always the same: keep cars moving and avoid financial loss. For buyers, this often translates into savings of 10–20% compared to the price paid by early-season shoppers.

Why Cars Become Unsold Inventory

Several factors contribute to vehicles becoming unsold inventory. These include seasonal shifts, regional preferences, and market timing issues that dealers must carefully manage. Even well-known brands deal with thisю. A sedan packed with luxury features might look great in the showroom, but struggles to find a buyer at its higher price point.

The 90-Day Turn Pressure

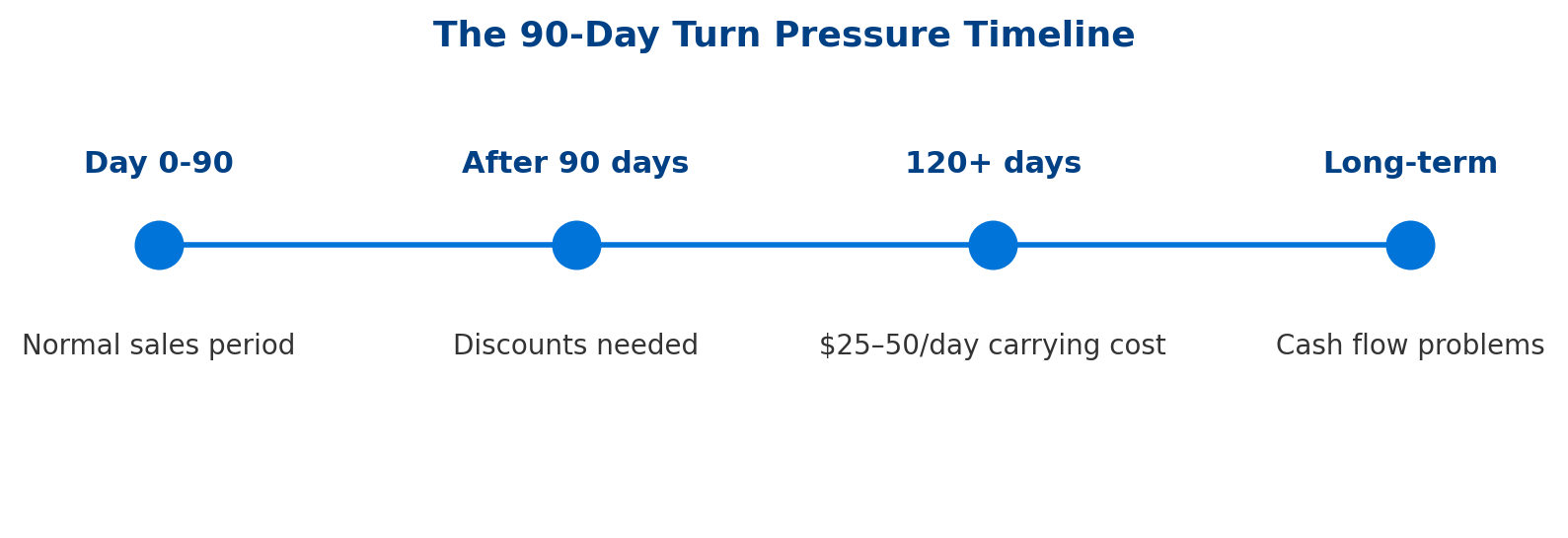

Most dealerships operate under intense pressure to deliver new vehicles within 90 days of arrival. This timeframe is crucial because manufacturers often provide floor plan financing that becomes increasingly expensive over time. When cars sit longer, dealership expenses rise significantly, forcing dealers to take several actions to trigger transactions and protect their profit margins.

The security solution for dealerships involves careful inventory management and pricing strategies. After 90 days, many cars require deeper discounts to attract more people and resolve the growing financial burden. Inventory that remains blocked on lots creates cash flow problems.

- Floor plan financing expenses increase after the initial period.

- Manufacturer incentives may change or expire.

- Storage and security expenses accumulate over time.

- Opportunity expenses prevent ordering new popular models.

- Cash flow problems develop from blocked capital.

Vehicles sitting over 120 days cost dealers an average of $25-50 per day in carrying expenses.

Seasonal & Regional Demand Mismatches

Regional preferences and seasonal buying patterns create significant challenges for car dealership operations. What works well in one country or region may struggle in another. Dealers must predict patterns months in advance, but buyer preferences can shift unexpectedly.

Weather patterns heavily influence vehicle distribution. Convertibles struggle in northern markets during winter months. All-wheel-drive vehicles may sit unsold in warmer climates. These mismatches force dealers to implement various security solutions to manage risks and protect blocked assets.

| Season | High Selling Vehicles | Low Selling Vehicles |

| Spring | Convertibles, Sports Cars | Heavy Trucks, AWD |

| Summer | Family SUVs, Convertibles | Snow Vehicles |

| Fall | AWD Vehicles, Trucks | Sports Cars |

| Winter | AWD SUVs, Pickup Trucks | Convertibles |

Which Brands and Models Are Most Likely to Go Unsold?

Premium manufacturers like BMW and Mercedes often struggle with specific trim levels that appeal to limited segments. Honda, despite strong overall performance, occasionally faces challenges with certain variants that don’t trigger immediate interest.

Vehicle complexity plays a major role. Cars loaded with expensive options may sit longer because fewer people can pay the higher price points. Dealership managers must balance offering variety while avoiding unwanted vehicles that block valuable lot space and tie up money.

Manual transmission vehicles represent a growing challenge, as most purchasers prefer automatic options. These cars require special attention from dealerships to find those willing to pay for such features.

- Luxury sedans with high option packages.

- Manual transmission vehicles across all segments.

- High-performance variants with limited appeal.

- Commercial vehicles in oversaturated markets.

- Previous-year variants when new versions arrive.

According to SCA, luxury vehicle inventory turns over 40% slower than that of mainstream manufacturers.

Car Body Types That Sit the Longest

Different vehicle types face varying challenges in the marketplace. Sedans have experienced declining interest as SUVs dominate preferences. Sports cars represent niche markets with limited pools of interested parties. Understanding these patterns helps explain what happens to unsold new cars and why certain types become unwanted vehicles.

Manufacturers continue producing diverse vehicle types to maintain market presence, but some categories naturally turn over more slowly. Dealership operations must develop specific strategies for each type, using targeted security solutions to minimize exposure and prevent too much blocked inventory.

| Body Type | Average Days on Lot | Main Challenge |

| Sports Cars | 85-120 days | Limited pool |

| Luxury Sedans | 75-110 days | Declining segment |

| Commercial Vans | 70-100 days | Seasonal patterns |

| Convertibles | 65-95 days | Weather dependent |

| Diesel Trucks | 60-90 days | Fuel preference shifts |

Where Unsold New Cars Go

When traditional marketing methods fail, dealers employ multiple channels to distribute new cars and protect their investment through various liquidation strategies. SCA data shows that roughly 15% of dealer inventory in the U.S. ends up at auctions each year, while the rest is absorbed through discounts, lease programs, or certification as pre-owned. For buyers, this means many of these cars eventually reappear on the market at lower prices

Discounted & Incentivized Sales

The first line of defense against unsold inventory involves aggressive pricing strategies. Car dealers work closely with manufacturers. The goal is to develop incentive programs that make vehicles more attractive to buyers. These programs protect dealership profitability while helping clear slow-selling stock and prevent further losses.

Finance options become crucial tools in these situations. Extended warranty programs and rebates help offset expenses on slow-moving vehicles. Dealers often combine multiple incentives to trigger interest and resolve challenges. For example, Honda dealerships might offer special lease rates combined with bonuses to clear specific variants.

Wholesale dealer license holders sometimes assist by purchasing multiple units for distribution to other markets where interest may be stronger. This word-of-mouth approach helps vehicles reach appropriate customers in different geographic regions.

- Rebates directly reduce purchase prices.

- Low-interest financing makes payments more affordable.

- Trade-in bonuses increase perceived value.

- Extended warranties provide additional security.

- Lease incentives lower the monthly payment burdens.

Rebranding as Certified Pre-Owned

Some manufacturers allow dealers to reclassify slow-moving new vehicles as certified pre-owned after minimal use. This process involves adding minimal mileage through demonstration drives or dealership use. The vehicles receive thorough inspections and extended warranties before entering the used car market.

This strategy helps resolve challenges while maintaining value for both dealers and buyers who benefit from nearly new car quality at reduced prices. Word spreads quickly about these opportunities through dealership networks.

Auctions and Liquidation Channels

When other methods fail, dealerships turn to auction systems to resolve cheap, unsold cars. These channels provide security solutions for management while ensuring vehicles find new owners. Professional auction houses specialize in handling excess dealership stock, creating competitive environments that help establish fair market values.

Selling at auto auction requires careful timing and realistic pricing expectations. Dealerships must weigh auction expenses against continued carrying expenses. Many auction events occur regularly, providing consistent opportunities to resolve problems and unlock blocked capital.

The auction process involves detailed vehicle inspections and condition reports. Participants include other dealerships, rental companies, and export businesses seeking specific vehicle types. There is no such thing as a guaranteed price, but auctions provide reliable liquidation channels.

| Auction Type | Typical Participants | Recovery Rate |

| Dealer-Only | Retail Dealerships | 85-95% of expenses |

| Public Sales | Consumers, Small Dealerships | 75-85% of expenses |

| Online Platforms | Nationwide Participants | 80-90% of expenses |

| Manufacturer Direct | Certified Dealerships | 90-95% of expenses |

| Export Auctions | International Dealerships | 70-80% of expenses |

How Can Consumers Benefit from Unsold Car Inventory?

Smart shoppers can find significant advantages by targeting not the used car but the unsold new car market. These vehicles offer brand-new car benefits. At the same time, they provide substantial saving opportunities. Understanding dealership motivations helps buyers negotiate better deals and access cars that might otherwise exceed their budgets.

Timing plays a crucial role in finding the best opportunities. End-of-year periods and seasonal transitions create ideal conditions for securing discounts on slow-moving stock. People willing to be flexible about colors and options often discover cheap, unsold new cars and off-the-lot cars with significant savings.

Research helps identify which cheapest cities for car buying offer the most opportunities. Regional differences create varying discount levels across different markets. VIN decoder services help verify vehicle history before purchase. Word travels fast among bargain hunters about the best opportunities.

- Year-end clearance events offer deep discounts.

- Color and option flexibility open more opportunities.

- Off-season purchases provide better negotiating power.

- Regional shopping reveals varying incentive levels.

- Manufacturer incentive stacking maximizes savings potential.

Risks of Buying an Unsold Car

While unsold vehicles offer savings opportunities, shoppers should understand potential drawbacks. These cars may have been shifted multiple times between lots or used for demonstrations. Some vehicles may have accumulated minor wear from being on display for extended periods, affecting their score in resale markets.

VIN decoder services help people research vehicle history and verify that the car hasn’t been used inappropriately. Careful inspection reveals any issues that might affect long-term ownership satisfaction. Grasping these risks helps people make informed decisions about leftover cars and unsold trucks.

Buying a car for cash provides additional negotiating leverage. Dealers prefer quick transactions that resolve challenges and improve their profit margins. Getting the word out about your serious buying intent can attract dealer attention.

| Risk Factor | Potential Impact | Mitigation Strategy |

| Extended Lot Time | Battery/Tire Issues | Pre-purchase Inspection |

| Demo Usage | Higher Mileage | VIN History Check |

| Multiple Transfers | Transport Damage | Detailed Inspection |

| Option Packages | Higher Insurance Expenses | Insurance Quote First |

| Limited Color Choice | Resale Value Impact | Market Research |

Summary

Understanding what happens to unsold new cars reveals a complex system designed to protect dealership investments while creating opportunities for purchasers. Dealers employ multiple security solutions, from aggressive discounting to auction distribution, ensuring few vehicles remain truly unsold. Smart shoppers can benefit from these situations by timing purchases strategically and remaining flexible about vehicle specifications, ultimately finding significant value in the automotive marketplace while dealerships maintain their profit margins and resolve blocked inventory. Whether working with a small dealership or a major corporation, the main word remains flexibility in negotiations.

FAQ

Are Demo Cars Ever Secretly Sold as New?

Reputable dealers clearly disclose demonstration usage, but some unscrupulous operations may obscure this information. Always check vehicle history and ask direct questions about previous use to protect yourself from such practices.

What Do Automakers Do with Unsold Limited Editions?

Manufacturers handle rare, limited-production cars differently than regular stock, often implementing special programs to protect exclusivity. No such thing as standard disposal exists for these vehicles.

– Corporate collections preserve significant variants.

– Museum donations maintain heritage.

– Employee programs provide exclusive access.

– Crusher programs eliminate excess inventory.

– Export markets find specialized participants.

Can a Dealership Refuse to Sell an Unpopular Car?

Dealerships generally want to sell all inventory, but they may be selective about people who might pay but create service issues or damage their reputation. Such a thing as refusing transactions rarely happens.

Do Unsold Cars Get Driven Occasionally While on the Lot?

Yes, car dealers periodically relocate cars to prevent mechanical issues, charge batteries, and rotate tire positions. This maintenance protects vehicle condition during extended storage periods and prevents further blocked inventory issues.

Can a Car Be Both a Leftover Model-Year and a Demo?

Absolutely. Previous-year variants often serve double duty as demonstration vehicles, allowing dealerships to showcase features while managing both challenges simultaneously. This practice helps operations maximize their investment return, and word about these opportunities spreads through dealer networks.