Contents

If you’re a victim of title jumping, start by gathering all documents: the bill of sale, the title you received, the seller’s contact info, and any payment records. Then file a complaint with your state DMV’s fraud division and your Attorney General’s office. Most states will require you to apply for a bonded title. This involves purchasing a surety bond worth 1.5× the car’s value and submitting a detailed ownership affidavit. Without this, you can’t register or insure the vehicle, and driving it may be illegal.

What Is Title Jumping and Why Is It Illegal?

Title jumping implies selling a vehicle without properly transferring the title. This practice creates gaps in the vehicle’s ownership history. It leaves buyers vulnerable to serious complications. Vehicle title jumping bypasses required sales tax payments, registration fees, and proper documentation processes. Grasping how to avoid title jumping is crucial for anyone considering a used car purchase, as it helps avoid falling victim to fraudulent schemes.

Why vehicle title jumping is illegal:

- Evades sales tax and registration fees owed to the state.

- Creates incomplete ownership history records.

- Facilitates potential fraud and money laundering.

- Leaves new buyers without clear legal ownership.

- Violates motor vehicle registration laws in all states.

- Can result in unpaid parking tickets being transferred to new owners.

Title Skipping vs Title Jumping vs Title Washing

These terms sound similar. However, they represent different illegal practices that affect vehicle ownership and imply distinctive suspicious activities. Vehicle title jumping specifically involves selling without transferring ownership. Title skipping and title washing have distinct characteristics.

| Practice | Definition | Primary Risk |

| Title Jumping | Selling without transferring title to the seller’s name | Unclear ownership chain |

| Title Skipping | Deliberately omitting ownership transfers | Hidden vehicle history |

| Title Washing | Moving titles across states to hide a negative vehicle history | Concealed damage/liens |

How Title Jumping Happens in Private Car Sales

Vehicle title jumping occurs in private party transactions when sellers want to avoid paying taxes and registration fees. The seller receives only a signed title from the previous owner, but never registers the vehicle in their own name before reselling it. This creates an open title situation that violates dealer regulations and proper title transfer requirements across all states.

SCA Expert Tip: “If the seller’s name isn’t printed on the front of the title as the legal owner, walk away. That’s a classic sign of title jumping.”

How to Spot Title Jumping Before You Buy

Recognizing title jumping signs safeguards you from legal and financial issues. Always verify that the seller’s identity matches the name in the title. Researching the vehicle’s ownership history reveals potential red flags.

Learning to identify title jumpers early in the process saves both time and money when purchasing vehicles.

Red flags indicating vehicle title jumping:

- Seller’s name doesn’t match the name on the title.

- Multiple missing signatures on the title document.

- The seller cannot provide registration documents in their name.

- Open title with blank ownership sections.

- Seller refuses to meet at their registered address.

- Unusually low price for the vehicle’s condition.

- Pressure to complete the sale.

- Claims of being a “one-owner” vehicle when documentation suggests otherwise.

According to the National Insurance Crime Bureau, title fraud affects approximately 1 in 325 vehicles sold annually in the United States.

How to Inspect a Vehicle Title Like a Pro

Professional title inspection prevents costly mistakes and legal consequences from vehicle title jumping schemes. Start by verifying all signatures are present. They should match the seller’s identification documents. Use a VIN decoder to confirm the vehicle identification number matches across all documentation.

Proper inspection techniques help ensure the registration process proceeds smoothly.

- Verify seller identity – Compare the driver’s license to the name on the title. Ensure the new owner’s name will be properly recorded.

- Check signature completeness – Ensure all required signatures are present and legible with completed paperwork.

- Examine title condition – Look for alterations, erasures, or suspicious markings.

- Confirm VIN numbers – Match VIN on title, vehicle, and registration documents.

- Review lien information – Verify there are no unpaid fees.

- Check title date – Ensure recent title transfer dates align with the seller’s story and verify ownership history.

- Validate notarization – Confirm notary stamps and signatures where required by state law.

- Research vehicle history – Check for salvage car accident records and undisclosed damage.

How a Bonded Title Works and When You Need One

A bonded title provides legal ownership when the original title is unavailable. This process requires purchasing a lost title bond worth 1.5 times the vehicle’s value. The bonded title protects previous owners and lienholders. It allows you to register the vehicle in your name.

Most states require bonded titles when standard title transfer procedures cannot establish clear legal ownership.

| Scenario | Bond Required | Typical Cost | Processing Time |

| Missing original title | Yes | $100-$500 | 30-60 days |

| Title jumping victim | Yes | $100-$500 | 30-60 days |

| Damaged title | Sometimes | $100-$500 | 15-30 days |

| Lost title with clear ownership | No | $15–$50 (DMV fees) | 15-30 days |

Can You Get a Refund If You Bought a Car with a Jumped Title?

Getting a refund after discovering title jumping depends on your state’s laws. The seller’s cooperation is also important. Contact the seller to demand a properly transferred title or a full refund. Many states have consumer protection laws. Don’t hesitate to recover costs when sellers engage in this practice.

Should You Still Keep or Sell the Car?

Quick fact: SCA Auctions reports that over 90,000 vehicles are flagged annually for title discrepancies that make them nearly impossible to resell legally.

Deciding whether to keep or sell a vehicle involved in title jumping requires careful consideration. Keeping the car means navigating the registration process. Potential legal complications are inevitable. Nonetheless, selling immediately might make you liable for continuing the illegal practice. Consult with legal experts and determine the best course of action.

| Option | Pros | Cons | Recommended Action |

| Keep Vehicle | Retain transportation, avoid loss | Legal complications, additional expenses | Obtain a bonded title first |

| Sell Vehicle | Recover some investment | Potential legal liability | Only with a proper title transfer |

| Return to Seller | Avoid legal issues | May lose money | Best option if the seller cooperates |

What Happens If the Title Is Lost or Damaged During a Jumped Sale?

When titles become lost or damaged during title jumping situations, resolving ownership becomes significantly more complex. The original title owner must typically initiate the replacement process, creating additional delays and complications. These scenarios often require bonded titles or extensive legal documentation to establish clear ownership. Working with experienced professionals familiar with how to fix a jumped title can streamline this challenging process.

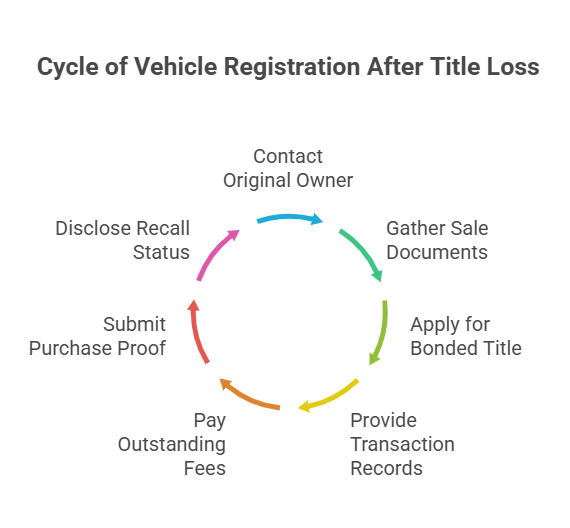

Steps when the title is lost or damaged:

- Contact the original owner for title replacement assistance and proper transfer documentation.

- Gather all available sale agreements and bill of sale documents proving the transaction occurred.

- Apply for a bonded title through your state’s DMV to register the vehicle legally.

- Provide detailed records of the transaction and vehicle history, including necessary documentation.

- Pay all outstanding registration fees and unpaid fees before completing the registration process.

- Submit the necessary documentation proving your purchase from the original owner.

- Disclose the recalled vehicle status.

SCA research shows that title-related fraud costs American consumers over $4 billion annually, with title jumping accounting for approximately 15% of these losses.

How Dealerships Handle Jumped Titles

Licensed dealers follow strict dealer regulations when encountering jumped titles and typically refuse such transactions. Car dealerships maintain detailed records. They cannot legally register vehicles without properly transferred titles. Accepting such titles could result in the loss of their car dealer’s license and substantial penalties.

How to Report Someone for Title Jumping

Reporting title jumping protects other potential buyers and helps relevant authorities track this practice. State DMVs and attorney general offices handle these complaints. They can impose severe legal consequences. Providing complete documentation strengthens your case. Many states now classify title jumping as a felony for repeat offenders.

How to report title jumping:

- Contact your state’s motor vehicle fraud division.

- File a complaint with the attorney general’s office.

- Provide all transaction documents and evidence.

- Include the seller’s name/contact information.

- Report to local law enforcement.

- Notify your insurance company.

Summary

Title jumping represents a serious illegal practice. It creates legal and financial consequences for unsuspecting buyers. Preventing title jumping requires careful inspection. Thorough research helps verify the seller’s identity and ensure properly transferred titles. Be especially cautious of reconditioned cars sold without proper disclosure. Understanding how to fix an open title and knowing your rights protects you from becoming another victim of this costly fraud.

FAQ

Can a Bank Repossess a Car Without a Title?

Banks can repossess vehicles without titles. Their lien rights supersede title possession. However, they must follow legal procedures. Selling the repossessed vehicle without obtaining proper documentation is impermissible.

What Disqualifies You from a Car Title Loan?

Several factors can disqualify applicants from car title loans. They primarily concern vehicle ownership and condition. Lenders require clear legal ownership and sufficient vehicle value to secure the loan amount.

Common disqualifications include:

– No clear title in the applicant’s name.

– Outstanding liens from other lenders.

– Vehicle value is too low for the desired loan amount.

– Poor credit history or bankruptcy.

– Insufficient income to support repayment.

– Vehicle in poor mechanical condition.

What Does a Forged Title Mean?

A forged title involves falsifying or altering official vehicle title documents. It implies misrepresenting ownership or vehicle history. This represents a title jumping felony in most states with legal consequences, including imprisonment and substantial fines.

Will Car Insurance Cover a Vehicle with a Skipped Title?

Most insurance companies provide coverage for used cars with title issues. However, claims related to ownership disputes may face complications. Contact your insurer to discuss coverage options and limitations.

Can a Notary Stamp Fix a Jumped Title?

A notary stamp cannot fix a jumped title since the fundamental problem involves missing ownership transfers, not just authentication. You must complete the title transfer process and register the used car legally to resolve title jumping issues.